Eazypips was founded in July 2020 by Vincent Nyagaka as a go-to Trading resource site for newbies and DIY users.

Over the last 5+ years, Eazypips has become the world’s largest free trading resource site for beginners, and it is often referred to as Wikipedia for traders.

In 2011, we joined the Benstrive family, a company our founder, Vincent Nyagaka, created to offer premier software, courses, and training for Traders. Today, our software and WordPress plugins are used by over 0.2 million websites, and our websites reach over 1 million pageviews every year.

At Eazypips, our main goal is to provide cutting-edge, helpful Trading tutorials that are easy to understand for small businesses, traders, and big traders.

Our Editorial Team and Editorial Process

Our editorial team at Eazypips is a group of Trading experts led by the most well-known trader guru, Vincent Nyagaka. Eazypips Editorial staff includes a dedicated team of programmers, writers, video creators, and editors with over 16 years of experience in Stocks, Commodities, Cryptocurrency, Forex Trading, and Indices.

Unlike other copycat tutorial websites, our team is full of true trading practitioners. We are passionate about the trading community and regularly contribute to trading core software.

Our highly-skilled editorial team manages every piece of content we publish at Eazypips. Before publishing, our content goes through different phases of the editorial process. And each editorial phase is managed by multiple team members, ensuring the content is thoroughly fact-checked and reviewed for accuracy and integrity.

How We Test Brokers

At Eazypips.com, our primary goal is to assist traders of all experience levels in discovering the most suitable broker for their trading needs. We achieve this by delivering unbiased and meticulously researched broker reviews.

Our team dedicates thousands of hours each year to thoroughly evaluating trading platforms, ensuring our readers receive accurate and comprehensive insights.

Our Core Values

Our editorial process is anchored by several principles that prioritize integrity and transparency. We uphold objectivity and openness in our assessment of products and services, irrespective of any potential affiliate partnerships.

The security of your funds is paramount to us. Therefore, we disclose information regarding the legitimacy and regulatory standing of brokers or services, and we promptly label any unsafe entities accordingly.

We are committed to offering candid opinions based on our rigorous evaluations. We refuse to present a biased viewpoint of a product or service to our readers. If we believe a broker can enhance their services, we will address it.

Testing Devices

Hardware/Software equipment that is used during the testing

All testing is conducted on the devices listed below. Mobile device testing is conducted using an 802.11n wireless WiFi connection; 4G connections are used when WiFi is not available. Unless noted, all websites and web-based platforms are tested using the latest version of the Google Chrome browser.

Desktop: Windows 10 Pro, 32 GB RAM, 64-bit Operating System, Intel Core i7-9700 CPU @ 3.00 GHz with Radeon RX 550 Video Card and 100GB of SSD Flash Storage.

Laptop: MacBook Retina 12”, 1.2 GHz Intel Core m5, Memory 8 GB LPDDR3 RAM, Intel HD 515 1536 MB Graphics card, 500 GB SSD Flash storage with the most current macOS (Mojave) operating system.

Smartphone: Samsung Galaxy S9+, 6.2″ 4K Super AMOLED (2960×1440) 64-bit Octa-Core Snapdragon 835 Processor 2.7GHz, 6GB RAM 6.2″ with the most current (Android 10 ) operating system.

Our Evaluation Methodology

We adhere to a stringent methodology that encompasses quantitative metrics covering over 100 data points and qualitative insights gathered during our evaluation process. This ensures that our conclusions are grounded in credible data sources and our assessments.

To assign brokers an overall rating, we assess various key areas:

- Trust – Regulatory status and reputation.

- Accounts – Accessibility and suitability for different requirements.

- Deposits & Withdrawals – Convenience, cost-effectiveness, and security.

- Investment Offering – Availability and diversity of global markets.

- Fees – Transparency and competitiveness of trading costs.

- Platforms & Apps – Reliability, features, and user-friendliness.

- Additional Tools – Availability and usefulness of extra features.

- Trading Restrictions – Limitations on trading strategies.

- Customer Support – Responsiveness and helpfulness.

- Suitability – Which type of trader does the broker best serve?

We elaborate on our testing approach for each category below.

Review Categories

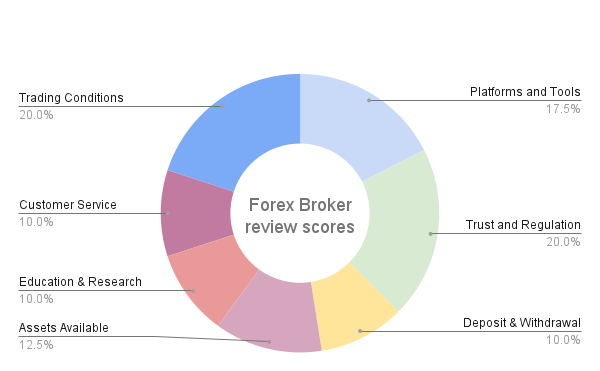

For the Eazypips.com 2024 Review, all brokers were assessed on 113 different variables across eight primary areas: Commissions & Fees, Offering of Investments, Platforms & Tools, Research, Trust Score, Mobile Trading, Education, and Overall.

The weightings of each category were as follows:

| Review Category | Weighting |

|---|---|

| Commissions & Fees | 11% |

| Platforms & Tools | 11% |

| Research | 16% |

| Trust Score | 25% |

| Offering of Investments | 10% |

| Mobile Trading | 16% |

| Education | 11% |

Category Scoring

Eazypips.com awarded “Best in Class” distinctions for all seven categories, as well as additional categories Social Copy Trading, Professional Trading, MetaTrader, Crypto Trading, Algo Trading, Beginners, Ease of Use, Trust Score, and Overall. A “Best in Class” designation means finishing in the top seven for that category. Individual Industry awards were also distributed.

An explanation of how the categories are assessed is shown below. For detailed commentary, view our broker guides.

Yes/No with Opinion

First, points are awarded for each “Yes” answer. The number of points awarded depends on the variable. Next, the total points earned from “Yes” answers are then divided by the total points possible to calculate a final Yes/No score.

To determine a final score for the category, this Yes/No score is then combined with an opinion score (1 – 10, with one being “very bad” and ten being “very good”). The weighting of the Yes/No score compared to the opinion score varies for each category. For example, 70% Yes/No, 30% Opinion.

Categories assessed in this manner include Offering of Investments, Platforms & Tools, Research, Mobile Trading, and Education.

Commissions & Fees

Commissions & Fees apply a separate scoring rate due to its complexity.

To score Commissions & Fees, first, multiple scenarios are assessed for placing trades. For example, the average reported and/or observed spread for the EUR/USD pair. Brokers are awarded points depending on how inexpensive they are relative to their peers.

Next, multiple scenarios are assessed for different investor types on a monthly basis, incorporating any miscellaneous account fees, alongside any active trader or VIP rates. The goal is to determine a net, “all-in” cost per trade.

Finally, all data is analyzed to determine an overall score for Commissions & Fees.

How We Review Brokers

We at Best Online Forex Broker aim to be the best independent source of broker reviews on the web. There are many new brokers created each month, and it is very difficult for a retail trader to know what is a trustworthy broker and what is a bad broker. Since brokerages spend an insane amount of money on marketing, it is usually unclear if the company is trusted or not. Some companies who scammed lots of traders in the past invested millions into PR campaigns that fooled a lot of traders who had the impression that they signed up with a world-class company, unfortunately, it was a Ponzi Scheme.

This is how the testing process goes:

- First and foremost, when we test, the broker is unaware!

- During the sign up we use VPN to mask the real IP address

- We open the demo account first to test the waters

- We make a small deposit using a credit card or Paypal ( we never do wire transfers as it takes time for money to appear on the trading account)

- We need to submit documents for KYC customer verification purposes exactly as any other retail trader

- We place a mini lot order

- Order is closed on the same trading day

- We test the customer support with 2 simple questions. Here we measure the response time and accuracy of their answers

- We make a withdrawal back to the original card

How We Calculate Forex Broker Trust

When we founded Eazypips back in 2020, one of our goals was to find a way to help forex traders across the globe easily identify trustworthy brokers versus those who warrant a closer consideration before opening an account.

This effort ultimately led us to develop Trust Score, a proprietary algorithm that incorporates data we collect from each forex broker to determine overall trust.

Each Trust Score is a numerical 1 – 99 rating, with 99 being the highest.

Trust Score Variables

So what goes into calculating the Trust Score? Variables tied into calculating Trust Score include total years in business, which regulatory licenses each firm holds, corporate structure (specifically, if the firm is publicly traded and if it is a bank), as well as an overall opinion score from our in-house industry expert, Vincent Nyagaka.

Here is a list of the regulatory licenses we incorporate currently. It is important to note that not all licenses are weighted equally. For example, becoming licensed by the Commodity Futures Trading Commission (CFTC) to operate in the United States is far more complicated, expensive, and, as a result, more significant than registering with the Financial Sector Conduct Authority (FSCA) in South Africa.

Here is a list of the regulatory licenses that are currently tracked and factored into Trust Score (ordering by tier, alphabetically by Country): Tier-1 Jurisdictions (High Trust):

- Australian Securities & Investment Commission (ASIC) – Australia

- Investment Industry Regulatory Organization of Canada (IIROC) – Canada

- Securities Futures Commission (SFC) – Hong Kong

- Japanese Financial Services Authority (JFSA) – Japan

- Monetary Authority of Singapore (MAS) – Singapore

- Swiss Financial Market Supervisory Authority (FINMA) – Switzerland

- Financial Conduct Authority (FCA) – United Kingdom (UK)

- Commodity Futures Trading Commission (CFTC) – United States

Tier-2 Jurisdictions (Average Trust):

- China Banking Regulatory Commission (CBRC) – China

- Cyprus Securities & Exchange Commission (CySEC) – Cyprus

- Central Bank of Ireland (CBI) – Ireland

- Israel Securities Authority (ISA) – Israel

- Financial Markets Authority (FMA) – New Zealand

- Central Bank of Russia (CBR) – Russia

- Financial Services Board in South Africa (FSB) – South Africa

- Securities and Exchange Commission (Thailand) – Thailand

- Dubai Financial Services Authority (DFSA) – United Arab Emirates

- Capital Markets Authority (CMA) – Kenya

Tier-3 Jurisdictions (Low Trust):

- Securities Commission of the Bahamas (SCB) – Bahamas

- International Financial Services Commission (IFSC) – Belize

- Bermuda Monetary Authority (BMA) – Bermuda

- BVI Financial Services Commission (FSC) – British Virgin Islands

- Cayman Islands Monetary Authority (CIMA) – Cayman Islands

- Mauritius’ Financial Services Commission (FSC) – Mauritius

Each year, we work to expand our database of countries we track and monitor. Forexassociation.co.ke is currently home to the largest independent database covering forex regulators on the web.

Trust Score Risk Levels

To simplify interpretation, we think of trust as three separate levels of counterparty risk: low, average, and high.

Low-Risk: 85 – 99

Low-risk firms are considered the most trustworthy. Put simply, we would not hesitate to open and fund an account with a low-risk broker (and we have numerous times). It is important to note though that low-risk firms are not immune from running into trouble, and our assessment of risk is by no means a guarantee of solvency for the indefinite future. Events like the Swiss National Bank abruptly removing its euro ceiling in 2015 are impossible to predict, and such market anomalies can have catastrophic effects on forex brokers.

Average-Risk: 70 – 84

Average-risk firms are firms we consider to be safe, but worth a closer inspection before opening and funding an account. At the least, we encourage traders to check the regulatory licenses for these firms to make sure they are regulated in the country they reside in. By being regulated in the country of residence, typically there are additional protection provisions in place in the case of a broker going under or getting into legal trouble.

High-Risk: 69 or below

High-risk firms should be scrutinized and carefully reviewed before opening an account. These forex brokers are, in most cases, operating without credible regulatory licensing and likely have a history of legal or financial issues. Before considering an account with a high-risk firm, we recommend checking the country rankings for your country of residence to see if a higher-trusted firm is available.

How to Compare Trust Scores

To see which countries each broker is regulated in and compare trusts side by side, use the Forex broker comparison tool.

Feedback

Have an idea of how we can improve our scoring methodology? Contact us, we’d love to hear from you.

How is WPBeginner Funded?

Running a popular website like WPBeginner that helps millions of users every month requires significant investment. Both on the server infrastructure part as well as on the content creation part.

Our team creates and maintains thousands of free written WordPress tutorials and hundreds of free videos tutorials.

So yes, we have to make money otherwise we would have to shut the site down. Below are two primary sources that fund WPBeginner.

Our Products

Over the years, we have created several premium WordPress plugins and business software to help you improve your website and grow your business.

Today, our software are used by over 25 million websites. When you purchase any of our premium WordPress plugins, it helps us fund WPBeginner.

We really appreciate everyone in the WPBeginner community who use and support our plugins. Thank you.

For more details on the plugin brands that we own or have invested in, please visit AwesomeMotive.com or see our premium WordPress plugins page here on WPBeginner.

Referral Fees

We earn referral fees when you buy services from companies that we recommend.

We only recommend products that we believe will add value to our readers. We thorougly test and use all products that we recommend. All opinions are our own, and we do not accept payments for positive reviews.

This monetization method is called affiliate marketing. The biggest brands on the internet offer affiliate programs such as Amazon, eBay, Google, etc. Many of your favorite sites use affiliate marketing to pay the bills.

You can learn more about it on our full FTC Disclosure page.

Forex Risk Disclaimer

“There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection, and market volatility that may substantially affect the price or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses.” Learn more.

By offering a comprehensive review of brokers through our detailed methodology, we empower traders to make informed decisions aligned with their financial goals, trading styles, and budgetary constraints.

Should you have any improvement suggestions, questions, or anything important regarding our broker’s rating methodology, you may contact us here.